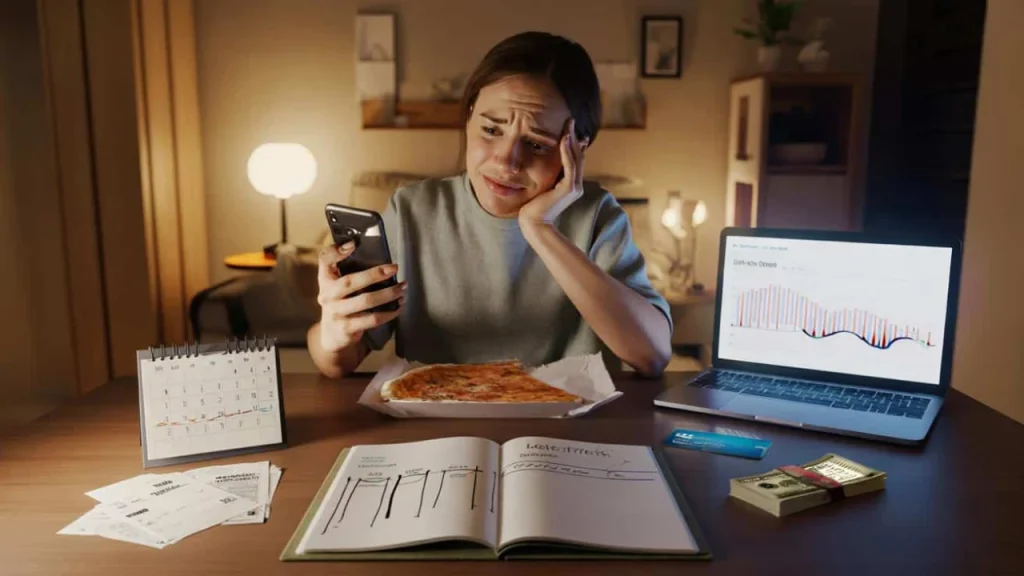

The notification came at 11:47 PM on a Tuesday. “Insufficient funds for automatic payment.” I stared at my phone, confused. Just three days earlier, my checking account showed over $2,800. I felt financially stable, even a little proud of myself.

But rent was due, my car insurance had auto-renewed, and Netflix, Spotify, and my gym membership all decided to charge on the same day. Suddenly, that comfortable balance meant nothing. I had money coming in Friday, but my bills didn’t care about Friday. They cared about today.

That’s when I learned the difference between having money and having money when you need it. It’s called cash flow management, and it completely changed how I handle my finances.

Why Your Bank Balance Doesn’t Tell the Whole Story

For most of my adult life, I treated my bank balance like a gas gauge. Full tank meant I was doing great. Half tank meant caution. Empty meant panic mode.

But money isn’t like gas. You don’t use it at a steady rate throughout the month. Your income might arrive on the 1st and 15th, while your rent leaves on the 5th, insurance on the 12th, and credit cards on the 22nd.

“Most people focus on their account balance, but cash flow is about timing,” explains financial advisor Sarah Chen. “You can have $3,000 in your account and still bounce a check if all your bills hit before your paycheck arrives.”

The revelation hit me when I started mapping out my actual money movement. I made $4,200 monthly, spent about $3,800, so mathematically everything worked. But the timing created these dangerous valleys where I’d have plenty of money on paper and zero dollars available in reality.

The Simple System That Changed Everything

Good cash flow management isn’t about making more money or spending less. It’s about creating a buffer between when money leaves and when it arrives.

Here’s the system I developed that eliminated those late-night panic moments:

- Map your money calendar – Write down every bill’s due date and your payday schedule

- Identify danger zones – Look for periods where large expenses cluster before income arrives

- Build targeted buffers – Keep extra money specifically for covering timing gaps

- Shift due dates – Call companies to move billing dates closer to your payday

- Automate smartly – Set up automatic transfers to smooth out the peaks and valleys

| Week of Month | Before Cash Flow Focus | After Cash Flow Focus |

|---|---|---|

| Week 1 | $2,800 (payday high) | $1,200 (steady state) |

| Week 2 | $1,900 (bills hitting) | $1,150 (minimal variation) |

| Week 3 | $200 (danger zone) | $1,000 (comfortable buffer) |

| Week 4 | $50 (barely surviving) | $950 (preparing for next cycle) |

The difference is dramatic. Instead of riding an emotional roller coaster every month, my account balance stays relatively stable. I sleep better knowing I won’t wake up to overdraft fees.

How This Approach Transforms Your Financial Life

Once you start thinking in cash flow terms, money stress decreases dramatically. You’re not constantly wondering if you can afford something. You know exactly what’s available because you’ve accounted for everything that’s already committed to leave.

“Cash flow management turns money from something that happens to you into something you control,” notes personal finance expert Mike Rodriguez. “It’s the difference between reacting to your finances and directing them.”

The practical benefits extend beyond avoiding overdrafts. When you understand your cash flow patterns, you can:

- Take advantage of opportunities without financial panic

- Plan larger purchases around your natural money rhythms

- Negotiate better payment terms with creditors

- Build savings consistently instead of sporadically

Six months after implementing this system, I had eliminated overdraft fees completely. More importantly, I stopped experiencing that sick feeling when unexpected expenses popped up. I knew exactly how much cushion I had and when more money was coming.

The Mistakes Everyone Makes With Cash Flow

Even after understanding cash flow basics, most people make predictable errors that undermine their progress.

The biggest mistake is treating your cash flow buffer like regular savings. That money isn’t for building wealth or buying treats. It’s operational funding that keeps your financial system running smoothly.

“I see people raid their cash flow buffer for vacations or impulse purchases,” observes financial counselor Lisa Park. “Then they’re right back to bouncing payments and borrowing from credit cards.”

Another common error is underestimating irregular expenses. Annual insurance payments, quarterly tax bills, and holiday gifts all create cash flow disruptions if you don’t plan for them.

The solution is treating irregular expenses like monthly bills. If you spend $1,200 on holiday gifts once a year, set aside $100 every month. When December arrives, the money is waiting instead of creating a cash flow crisis.

Making Cash Flow Management Automatic

The best cash flow systems run themselves. Once you’ve identified your patterns and danger zones, automation handles the heavy lifting.

I set up automatic transfers that move money around based on my monthly rhythm. When my paycheck hits, portions immediately move to different accounts: rent money, bill money, and cash flow buffer money.

This creates artificial scarcity in my main checking account. What’s left after automatic allocations is truly available for discretionary spending. No mental math required, no wondering if I can afford something.

Technology makes this easier than ever. Most banks offer automatic transfers, and apps like YNAB or Mint can track cash flow patterns for you. The key is finding a system simple enough that you’ll actually use it consistently.

FAQs

How much should I keep in a cash flow buffer?

Start with one week’s worth of expenses, then build up to cover your longest gap between income and major bills.

What if I have irregular income like freelance work?

Cash flow management becomes even more important with irregular income. Build a larger buffer and base your monthly spending on your lowest typical month.

Should I use credit cards to smooth cash flow gaps?

Credit cards can work as a temporary solution, but they create new timing problems with payment due dates. Building a proper buffer is more reliable.

How do I handle unexpected expenses with cash flow management?

True emergencies might require dipping into your buffer, but rebuild it immediately. Many “unexpected” expenses are actually predictable if you track patterns.

Can cash flow management help me save more money?

Absolutely. When you’re not paying overdraft fees and credit card interest, more money stays in your pocket. Plus, seeing your true available spending often reveals opportunities to save.

How long does it take to set up a cash flow system?

The basic mapping takes about an hour. Building adequate buffers might take 2-3 months, but you’ll see benefits immediately.