Marie Dubois had been avoiding the cash machine on Rue de la République for months. At 68, her eyesight wasn’t what it used to be, and the tiny buttons and cramped screen text made every withdrawal feel like a puzzle she couldn’t solve. Last Tuesday, she approached the same ATM with her usual anxiety, only to discover something remarkable had changed.

The machine greeted her with a clear, friendly voice asking if she’d like audio assistance. For the first time in years, Marie completed her transaction without squinting, without frustration, and without asking a stranger for help. What she didn’t know was that she had just experienced France’s newest banking revolution in action.

Across the country, millions of French citizens like Marie are about to discover that their relationship with cash machines is changing forever, thanks to a groundbreaking European regulation that’s reshaping how banks serve their customers.

The Game-Changing Rule That’s Transforming Cash Machines in France

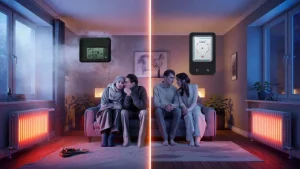

Since June 28, 2025, every new and renovated ATM across France must comply with strict accessibility standards. This isn’t just another bureaucratic checkbox – it’s a fundamental shift that recognizes the 12 million French citizens living with some form of disability.

The European Accessibility Act, now mandatory for all French banks, requires cash machines to serve everyone, regardless of their physical abilities. Think of it as the digital equivalent of wheelchair ramps, but for banking.

“We’re not just talking about a few extra buttons,” explains banking accessibility consultant Laurent Moreau. “This regulation transforms the entire user experience, making it inclusive by design rather than as an afterthought.”

The change affects every major French bank – from BNP Paribas and Crédit Agricole to Société Générale and smaller regional institutions. No exceptions, no delays, no excuses.

What These New Features Actually Mean for Your Daily Banking

Walk up to any newly compliant cash machine in France, and you’ll immediately notice the difference. The transformation goes far beyond what meets the eye, creating an entirely new banking experience.

| Feature | How It Works | Who Benefits |

|---|---|---|

| Audio Guidance | Voice instructions for every step | Visually impaired users, elderly customers |

| Headphone Support | Private listening via standard jack | Users wanting discretion, hearing aid users |

| High Contrast Display | Bold text, clear backgrounds | Low vision, outdoor visibility |

| Adjustable Text Size | Scalable fonts up to 200% | Age-related vision changes, reading difficulties |

| Extended Time Limits | Longer transaction windows | Mobility issues, cognitive processing needs |

The most revolutionary feature is the audio system. Users can plug in any standard headphones and hear step-by-step instructions for their entire transaction. The system announces account balances, confirms withdrawal amounts, and even warns about security steps.

For customers with partial vision loss, the high-contrast mode transforms fuzzy gray text into bold, clear characters against sharp backgrounds. Meanwhile, the enlarged text option can increase font sizes by up to 200%, making screens readable without glasses for many users.

“The beauty is that these features help everyone,” notes disability rights advocate Sophie Chen. “Elderly users benefit from clearer displays, tourists appreciate audio guidance in multiple languages, and anyone using an ATM in bright sunlight finds high contrast invaluable.”

How This Changes Everything for French Banking

The ripple effects extend far beyond individual transactions. French banks are essentially rebuilding their entire ATM infrastructure, and the changes are reshaping how financial institutions think about customer service.

Currently, France operates approximately 51,000 cash machines. While many modern ATMs already include some accessibility features, the new mandate requires comprehensive compliance across the board. Banks face a choice: upgrade existing machines or replace them entirely.

The cost implications are substantial. Industry estimates suggest banks will spend between €200-500 per machine for software upgrades, while full replacements can cost €15,000-25,000 each. For major banks operating thousands of ATMs, we’re talking about investments in the tens of millions of euros.

But there’s a business case beyond compliance. France’s aging population means accessibility features serve a growing market segment. By 2030, over 24% of French citizens will be over 60, many dealing with age-related vision, hearing, or mobility changes.

“Banks that see this as just a regulatory burden are missing the point,” argues fintech analyst Pierre Durand. “This is about serving customers better and tapping into previously underserved markets.”

The Real-World Impact You’ll Notice

The transformation is already visible in major French cities. In Paris, newly compliant machines feature prominent headphone jacks and clear audio symbols. Lyon’s banking district showcases machines with dramatically improved screen visibility, while Marseille’s tourist areas now offer multilingual audio support.

Banks are taking different approaches to implementation. Some are retrofitting existing machines with new software and hardware additions. Others are fast-tracking complete replacements, seeing this as an opportunity to modernize their entire fleet.

The timeline varies by institution, but the mandate is non-negotiable. Every new ATM installation or major renovation must meet the accessibility standards immediately. Existing machines have longer compliance windows, but banks are accelerating upgrades to avoid customer service gaps.

Customer reactions have been overwhelmingly positive. Beyond the primary beneficiaries with disabilities, regular users appreciate features like better screens for outdoor use and clearer transaction confirmations.

Regional banks are finding creative solutions too. Crédit Mutuel has partnered with local disability organizations to test their new interfaces, while some cooperative banks are using the upgrades to add services like multi-language support for diverse communities.

“We’re not just meeting regulations,” says banking innovation director Anne Leroux. “We’re discovering that accessible design creates better experiences for everyone.”

The changes represent more than technological upgrades – they signal a fundamental shift toward inclusive banking that recognizes the diverse needs of modern French society. As more machines come online with these features, the banking experience is becoming more welcoming, more intuitive, and more human.

FAQs

Do all cash machines in France now have these accessibility features?

Not yet, but all new and renovated ATMs must include them since June 28, 2025. Existing machines are being upgraded on a rolling basis.

Will using accessibility features cost extra money?

No, all accessibility features are provided free of charge as part of standard ATM services.

Can I use my own headphones with the audio guidance system?

Yes, the machines accept standard 3.5mm headphone jacks, so any regular headphones or earbuds will work.

Are the audio instructions available in languages other than French?

Many machines offer multilingual audio support, typically including English, Spanish, and other commonly spoken languages in the area.

How do I activate the accessibility features on a cash machine?

Look for clearly marked accessibility buttons or symbols on the screen or keypad. Most machines also provide audio prompts asking if you need assistance when you insert your card.

Will these changes affect transaction times for regular users?

No, accessibility features only activate when requested. Regular transactions proceed at normal speed unless you choose to use the additional features.